Bitcoin event, savings rates and Big Brother NatWest

Jasmine Birtles' News Uncut Money Round-Up

By Jasmine Birtles

Come to my exclusive, free Bitcoin event in London

IF, like me, you are watching fiat currencies lose their value – particularly the US currency as the petro-dollar falters – you will be wondering what the next form of ‘stable’ money will be.

Some sort of gold-backed currency seems likely, but cryptocurrencies are also developing fast, particularly Bitcoin, which hit a new high this year (although it has dropped down since).

So I’m hosting a panel discussion this week at an exclusive club in Knightsbridge with the title: ‘Will Bitcoin go to $100k?”

….and you’re invited, for free.

It is from 6-8pm on Thursday July 11 at Pavilion, 64 Knightsbridge and will start with free drinks and nibbles before the discussion gets going around 6.30pm.

For more information, and to sign up for free, click on this link.

NatWest- the new Big Brother

ANYONE banking with the NatWest app will be shocked to find the bank ‘nudging’ them to buy ‘plant-based milk’ or ‘vegetarian meals’ instead of their pint of full-fat and steak at the supermarket.

The bank – which the taxpayer bailed-out in the 2008 financial crash – has taken it upon itself to ‘suggest’ to its customers different ways they should live. Not surprisingly, farmers, in the form of the National Farmers’ Union, have shown their disgust at this attack on the dairy and meat industries. But it has not deterred the bank.

Anyone who is into vegetarianism and, in particular, anyone who believes in Net Zero might be pleased at this activism from a high street bank.

Others, though, question the right of an immoral institution that has been fined numerous times for financial irregularities (e.g. In 2021, they were fined £264million for failing to prevent money laundering,) to tell anyone what to do with their lives.

NatWest have been particularly energetic in cancelling customers whose views they pretended not to like – Our accounts were closed without reason – including, of course, Nigel Farage, through their sister bank Coutts.

If you have an account with NatWest, now would be a good time to switch to a better one. Currently Chase bank is offering 5.1 per cent on savings plus one per cent cashback and five per cent ‘round-up’. First Direct – consistently top of the pops for service – is offering £175 just to switch to them, plus a seven per cent regular saver account (for up to £300 a month).

And speaking of savings accounts…

Last month I mentioned a new trading platform called Trading212. They have a really good offering when it comes to share dealing but they also have a really good Cash ISA rate for the moment. They are a new company, so they are going all-out to bring in the customers with some giveaway deals – it will not last so it is worth grabbing the good offers while they are there!.

It is a flexible account so you can withdraw your money any time (i.e. when you see a better offer somewhere else) and it is 5.2 per cent AER (variable). Check it our here.

Is our money safe?

IT IS worth reading this Substack by Efrat Ferguson (a seasoned freedom fighter) detailing some of the authoritarian moves by banks around the world in the last few years.

This includes the US president having the power to order Israeli bans to confiscate your bank account if you are considered politically dangerous (on either side); Australian NAB Bank announcing the freezing of bank accounts of those who express themselves online in a way they disapprove of; Germany announcing plans to target bank accounts of people who donate money to groups and entities considered ‘extreme right’ (whatever that is now). And that’s just a small sampling of bank extremism across the West.

Where can you put your money to be safe? Gold is a good place to start (and possibly finish) although it is hard to spend with it, unless you use one of the digital gold cards like Tallymoney, which immediately invests your money in gold while giving you a Mastercard with which you can spend it.

There are various ways to invest in gold to protect your wealth and I will go through more of them in the August round-up.

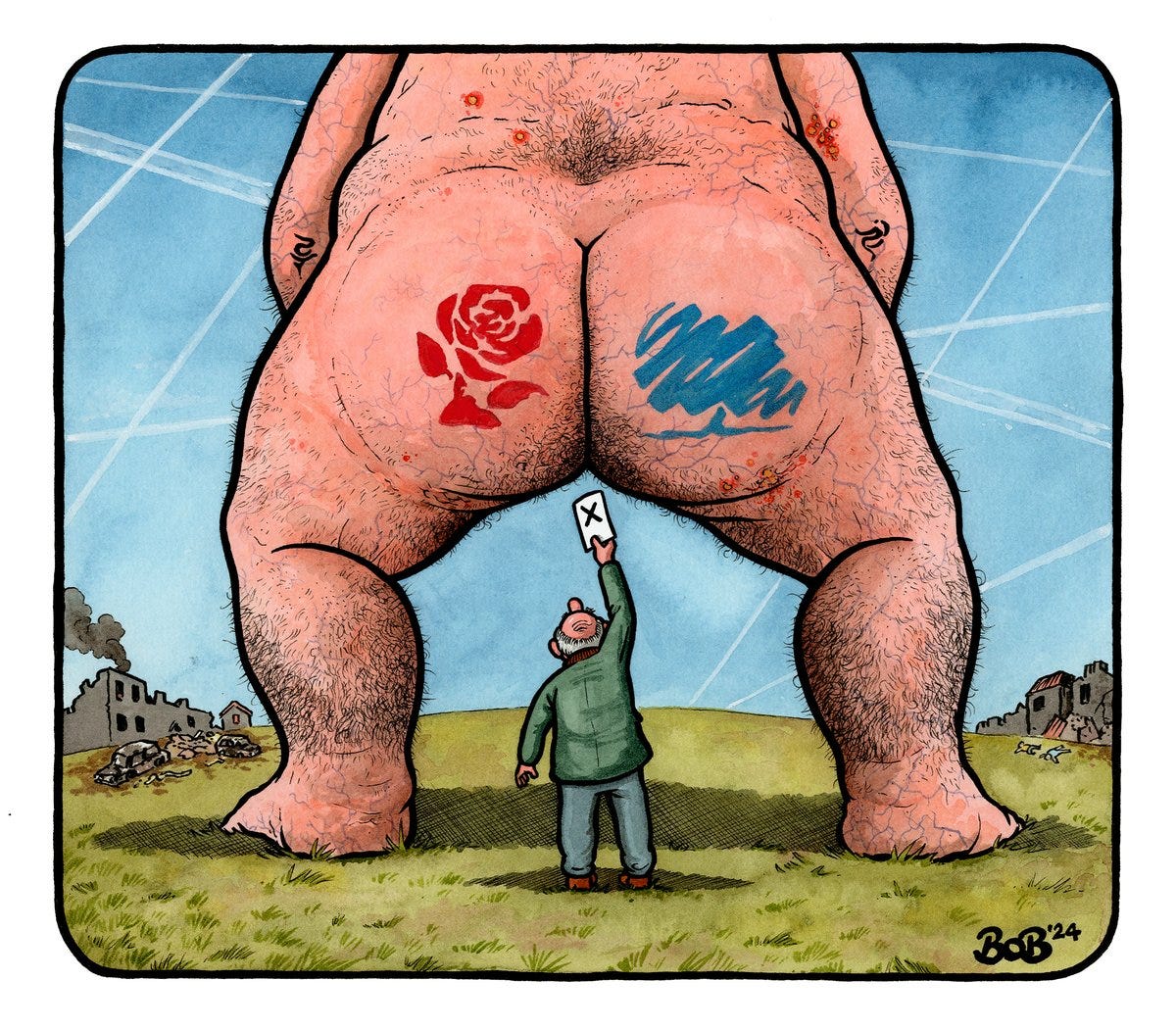

And also in August…

ONCE the new Labour Government has got its feet under the table, I’ll be going through their stated policies and give you ways to protect your money going forward…particularly against tax.