LOCKDOWN: HOW IT IS NOW SQUEEZING OUR BELTS SO TIGHT WE CAN BARELY BREATHE

Forget Ukraine... cost of living scandal is down to our Government

By Jasmine Birtles

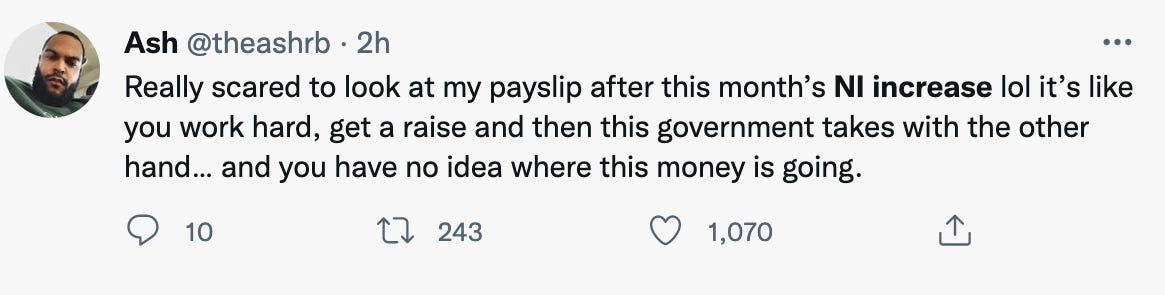

ANOTHER day, another price rise – or tax rise anyway. The first day of the new tax year yesterday saw an increase (temporarily) in the National Insurance (NI) rate for workers and employers. It will drop in July, thankfully, meaning that those on less than £34,000 a year will actually see a small reduction in their NI payments compared to what they were paying in the last tax year. The rest will continue to pay more.

With the tax increase in place, by next year, as wages go up, more will find themselves in the higher NI payment bracket. And so it will go on.

It is just another pull on the nation’s belts, already tightened so much that many can barely breathe.

Every day there are more statistics about how hard it is for millions to cope.

For example:

We borrowed another £1.5billion on credit cards in February – the biggest monthly hike in at least 30 years. It took the annual rise in card borrowing to 9.4 per cent.

Consumer credit overall was up 4.4 per cent in a year – the biggest increase since the onset of the pandemic.

Council tax bills have risen by an average of 3.5 per cent to an average of £1,966 for band D properties (up £67)

The ONS (Office of National Statistics) reports that, in early 2022, 29 per cent of people said they could not afford a £850 expense out of the blue

The Department for Work and Pensions (DWP) has found that one in seven families have no savings and two in seven have savings of £1,500 or less – both were down from a year earlier, but now it is crunch time for these savings

Private rental payments have shot up to £149 a week (£142 a year earlier) and mortgages to £150 (£143 a year earlier). In London this rose to £288 in rent or £265 on a mortgage (£276 and £245 last year). Mortgages are set to continue to increase as interest rates are likely to rise this year

Mobile phone operator Lebara says that more than three quarters of respondents to their survey are most worried about their energy bill increasing. 60 per cent of Brits expect to see their bills rise by £100 per month

Our Government and other governments in the West are trying to pin the blame on the Ukraine crisis. Certainly we have seen and will see the negative financial effects of that in many areas of our lives, especially food (wheat, other grains and various foods come from both Ukraine and Russia and fertiliser costs have shot up partly because of a shortage of potash coming from that region) and oil (although other oil producing countries could fill that gap if they were willing to).

But it was clear to many of us early last year, before the Ukraine invasion was a twinkle in Putin’s eye, that inflation was going to be the big story for 2022 and beyond.

Essentially we can put the root cause down to lockdown.

The current (and future) pain is what people like those of us at News Uncut were warning about in 2020 – and were shouted down for saying so.

Firstly, the lockdowns disrupted world production and trade. Commodities were particularly hard hit. Many mining operations shut down. There was no flying in and out of countries. Food production was interrupted or halted and companies that provide raw materials saw output fall dramatically in some sectors.

Even now we have businesses that are affected by the ‘pingdemic’ where workers have either received a (probably false) notification that they are infected or they actually have symptoms, so they stay at home.

Lower supply and increasing demand push prices up and this is the ‘short-term’ set of price rises that we were promised by central banks at the end of last year.

But the bad news, as far as I’m concerned, is that this is not a short-term thing, however much the central banks would like us to think it is.

Why? Because of the even more poisonous outcome of lockdowns which is Quantitative Easing (QE), or money-printing, that was been practiced to the max by Britain, the EU and, in particular, the USA.

Central bankers got the money-printing bug during the financial crisis at the end of the Naughties when they used it to get the banks out of a hole.

It was supposed to be a short-term fix, but never really went away.

Come the 2020 lockdown fury, a massive overreaction to the Wuhan Flu and we were printing money on toilet paper. One stat that has been doing the rounds on the internet in recent months is that 80 per cent of all dollars in existence were printed in the last two years. That gives you something of the scale of it.

Real inflation happens when the amount of money increases and each unit of money is worth less than it was last year (or even last month if you have lived in Argentina or Zimbabwe).

The inflation we have had so far has been supply shock price rises but not true inflation. True inflation is still to come and that will be because of the devaluation of our currencies through QE.

Oh joy.

There is a similarity with the 1970s here and, as Nick Hubble explains in one of his excellent discourses on inflation here, the spectre of stagflation (a stagnant economy with rising prices) is rising its head (has been since last year actually).

In the 1970s it took extraordinarily high interest rates and a few years of pain – for the consumer of course, not anyone in power – to get us out of the stagflationary mess.

Nick Hubble says we have the same sort of 1970s script going on now too. “We’ve got all the same mistakes like price controls being demanded by politicians which then create shortages,” he says.

All of this because of a policy, borrowed from China and not included in the country’s original plans for dealing with what might be a pandemic, which is increasingly now being dubbed a failure by researchers. Yup – lockdown.

According to Professor Mark Woolhouse, an epidemiologist at the University of Edinburgh, the lockdown policy did not work. As he says in his book ‘The Year the World went Mad’: “Lockdown will be viewed by history as a monumental mistake on a global scale, for a number of reasons.

“The obvious one is the immense harm the lockdown, more than any other measure, did in terms of the economy, mental health and on the wellbeing of society.” Article here

Will UK consumers finally admit that the lockdowns were not only unnecessary but actively harmful for the longterm health, wealth and wellbeing of the nation?

I’m not holding my breath but I do think that it is a positive sign that those who oppose the concept are finally being allowed some sort of voice in parts of the mainstream media. There are certainly signs of people questioning the source of the current financial pain and wondering what is going to happen to the global economy in the next year Link.

Let’s keep talking about it with friends, family and neighbours and make sure that more people at least ask the questions about why we have such steep price rises both here and in other countries around the world. It is really not just about the war.

I was going to buy Mark Woolhouse’s book but if his conclusion is that economy, health. and society-wrecking policies were a merely innocent “mistake”, then I won’t bother.

In the '80s a certain PM was a monetarist and we had the Money Supply Argument which involved all sorts of stuff like M3, M4 which confusingly weren't motorways but credit supply, the money printing presses and the velocity of money (or was that Keynes?) Anyway, Auntie took it seriously and would tell us about it in great detail whilst also telling us which shipyard or engineering company had just closed its doors that day forever.

It was all v uncomfortable with interest rates of 15% but brought down inflation in the end. Maybe we'd have been better off keeping the industry and being a banana republic but people always get vilified if they try the hard line. And usually get stabbed in the back by their own kind. And don't get re-elected; I can't see Bojo doing anything that smacks of that discipline.